In other words, the company might sell off the property to cover withdrawals or other liabilities, if needed. As for cryptocurrencies, this would include the extra well-liked coins, such as Bitcoin and Ethereum, and stablecoins, like Tether, USDC, or BUSD. Some exchanges and crypto lending platforms, together with Kraken, Nexo, BitMEX, and Gate.io, moved to launch their proof of reserves before the implosion of FTX. The investors of the crypto market vary from opportunistic day traders to steadfast HODLers, however what they’ve in widespread is the desire for a return on funding. Market liquidity is important within the crypto market as a outcome of it means traders could make quick trades without destabilising a coin or token as there are many consumers willing to purchase or commerce the digital asset.

In addition, PoR can work to guarantee clients that the crypto platform isn’t in jeopardy of experiencing liquidity issues and that their funds can be found for withdrawal at any time regardless of wider market conditions. Chainlink Proof of Reserve provides each the growing DeFi ecosystem and the traditional monetary system with a approach to boost the transparency of their operations through definitive on-chain proof of any asset’s true collateralization. As the good contract ecosystem grows, it is crucial to make sure market failures caused by opaque operational processes and poisonous collateral are consigned to historical past.

However, authorities regulations corresponding to imposing licenses on crypto custodians and mandating advanced safety practices may still be required to realize the highest degree of trust. Over time, combining both types of rules might make the cryptocurrency industry safer for retail and institutional investors. Other platforms such as Gate.io do have a PoR attestation course of that verifies the other a part of this equation. Its auditor, Armanino, takes periodic snapshots of anonymized user balances and the exchange’s proven ownership of funds. If an entity temporarily borrows funds for the snapshot, then they’ll make it appear that they’re solvent with out really having the necessary means to totally cowl potential withdrawals. Binance change’s CEO Changpeng Zhao, on November 6, 2022, raised a difficulty on the state of the second largest cryptocurrency trading platform – FTX.

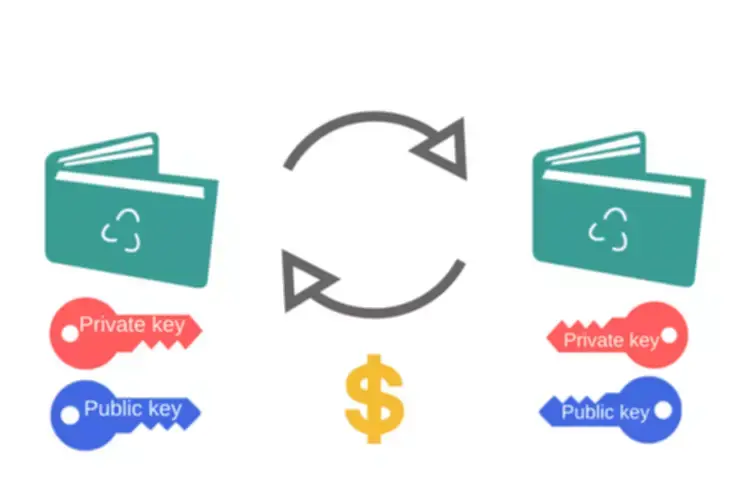

Centralized exchanges are providing prospects with services to confirm the state of the assets held on their platform. Through this, clients are in a position to confirm that the institution truly holds these assets with an equal or extra reserve to again the deposits, making certain that prospects will all the time be succesful of withdraw their holdings. Proof of reserves employs a safe information construction often identified as a Merkle tree (or hash tree), which aggregates the total of all customer balances without exposing any personal information.

It uses cryptographic proofs and public pockets address ownership verification together with periodic third party audits to publicly attest that a centralized platform holds sufficient property to match user deposits. This cryptographic method makes it possible for particular person users to confirm that their account stability is included in the attestation. Chainlink PoR feeds can be used for a variety of tokenized real-world property what is proof of reserves (RWAs), corresponding to actual estate properties that generate verifiable money flows. Chainlink PoR can additionally be used to help the tokenization of other kinds of RWAs, corresponding to commodities like gold and silver. Paxos and CACHE Gold are using Chainlink PoR to allow anybody to quickly verify on-chain that their tokenized gold products are fully backed by gold reserves held in off-chain custody.

Unlocking The Potential: How Proof-of-reserves Is Changing The Sport

With the expansion of DeFi comes an rising demand for brand new collateral sorts that stretch beyond native on-chain property, together with cross-chain tokens, fiat-backed stablecoins, tokenized real-world belongings, and extra. Custodial institutions within the cryptocurrency area hold the belongings of their prospects in a sizzling pockets from which they serve withdrawal requests from users. Customers of custodial monetary platforms aren’t in complete custody of their assets, as the institutions hold https://www.xcritical.com/ the non-public keys to those addresses. The aim of providing proof of reserves is to supply monetary transparency about a crypto company’s balance sheet, especially in regard to customers’ funds. A third-party audit provides customers confidence that the crypto firm they’re using has adequate liquidity to deal with day-to-day operations, and extra importantly, buyer withdrawals. The latest high-profile collapses of main crypto platforms, nevertheless, have brought the integrity of those custodians into question.

Proof of reserves (PoR) is the method of verifying that the client property held by a cryptocurrency change or financial establishment correspond to the variety of assets the company holds in reserve on behalf of the customers. PoR has been highly publicised as the first solution for crypto traders to ensure that their funds are being secured appropriately. It’s also a nice tool for crypto platforms as it supplies a way to prove they’re solvent i.e. possessing enough assets to cover trades and withdrawals. Chainlink Proof of Reserve supplies smart contracts with the info needed to calculate the true collateralization of any on-chain asset backed by off-chain or cross-chain reserves. Proof of reserves (PoR) is an attempt to provide public transparency to centralized crypto forex reserves via a verifiable auditing practice.

The crypto market is already on the restoration course from its current setbacks, however, it’s important to stay vigilant and discerning in relation to who you belief along with your funds. Bitpanda is proud to be recognised as one of the most secure and most regulated platforms in Europe. We understand and welcome the elevated demand from crypto traders for improved monetary transparency throughout the board. In relation to PoR, Merkle trees are particularly useful for auditors because it allows them to maintain customer privacy.

Automated Access To Our Sites Must Comply With Secgov’s Privacy And Security Policy

Asset tokenization projects similar to TUSD, PoundToken, and Cache Gold have integrated PoR Secure Mint to make use of this commonplace for tokenized asset transparency, security, and verifiability. Proof of Reserve historically refers to businesses that hold cryptocurrency creating public attestations concerning their reserves to prove their solvency to their depositors through an unbiased audit. As these audits are generally carried out by a centralized third get together, they can be lengthy, time-consuming, and require handbook processes. Proof of Reserves (PoR) verifies digital asset collateralization held by crypto businesses, serving to deliver higher transparency to depositors via public attestations and independent audits. Therefore, the best reserve property include bitcoin (BTC), ether (ETH), and stablecoins similar to tether (USDT), USD coin (USDC), Binance USD (BUSD), and dai (DAI).

The cryptocurrency trade may immensely benefit from custodians adopting proof-of reserves requirements in the occasion that they absolutely disclose the dangers of this sort of self regulation to their customers. If the industry succeeds in implementing common accountability standards, the move may forestall setbacks that always end result from the implosion of centralized platforms corresponding to Mt. Gox, Cryptopia, QuadrigaCX and FTX. Like conventional monetary institutions, auditors should evaluation the reserves as a end result of they use industry-certified accounting requirements and provide third-party affirmation. Users thus can rely on one thing aside from a custodian’s self-assessment, which may be easily skewed or falsified. Nexo launched in 2018 and presents a platform for users to earn curiosity on their crypto or draw credit score traces using their crypto as collateral.

How To Confirm A Company’s Reserves?

Customers can also easily uncover whether property are being rehypothecated, not backed by a stable basket of property, or utilized for different high-risk activities that might jeopardize their availability. Industry gamers also can utilize tools like those outlined above to ensure the security and availability of the funds, establishing a process that could help make the crypto area safer for investors. Now that you’re acquainted with the concept of Proof of Reserves, you’re able to dive deeper and carry out your own research on completely different centralized platforms. In that sense, a Proof of Reserve records a mini Merkle Tree of an exchange’s property and liabilities on-chain.

Changes to the person balances are simply detected on the Merkle tree and it creates a pointy shift in the data structure. Through this, it will be unimaginable for institutions to tamper with users’ balances and go undetected. Details of property held by the institution may be partly obtained by tracing particulars of transactions involving their hot and cold wallets.

What Is A Proof-of-reserves (por) Audit?

Launched in 2011, Kraken is likely considered one of the main cryptocurrency exchanges pioneering proof of reserve audits. The platform launched its PoR program in February 2022 with a commitment to offer semi-annual updates relating to the value of buyer assets. During an audit, the third-party auditor obtains proof of reserves by taking an anonymized snapshot of consumer balances.

While proof of reserves could be touted as a method to present a crypto company’s solvency, there are nonetheless ways to thwart this, including having off-chain liabilities or colluding with the auditing group. But that being said, proof of reserves is more likely to turn into the minimal disclosure normal for any crypto company going forward. Secure Mint is being built-in by stablecoins, similar to Poundtoken, and tokenized belongings, such as Cache Gold, of their minting sensible contract to assist guarantee reserves are enough before minting new tokens. Chainlink PoR Secure Mint enhances stablecoin and tokenized asset security by offering cryptographic guarantees that new tokens minted are backed by reserves, serving to to stop infinite mint assaults.

Using its technology, you can view institutional and particular person wallet balances throughout selected chains and explore other particular knowledge that can assist estimate the impact of your institutions’ activities in your finances. Doing it will cut back the chances of buyers dropping their property to unlucky occasions resulting from poor administration of users’ funds by a custodial establishment. Investors also can modify or withdraw their investments to attenuate losses, within the event that they feel that the platform’s custody practices have turn into too dangerous over time. A proof-of-reserves (PoR) audit of a crypto firm generates a certification known as an attestation. Audits could additionally be performed on an everyday schedule (such as monthly or quarterly), however some crypto corporations provide a real-time proof-of-reserves stability on their website, which is updated a number of occasions a day. Assets which may be thought of reserves are cryptocurrencies (or other types of assets) that offer sturdy liquidity.

Avalanche’s distinctive architecture has efficiently attracted distinguished sport developers and financial establishments to affix the ecosystem. In light of the FTX demise, many players in the centralized change house and others have rapidly established proof-of-reserve initiatives. The specifics of each proof-of-reserves program are inclined to vary, with many different approaches being adopted. In Crypto.com’s choice to disclose its wallet addresses, it revealed that 320,000 ETH was despatched to Gate.io on Oct. 21, 2022. Crypto.com and Gate.io introduced that the transaction was a mistake, and the funds had been later returned.

- Once Chainlink PoR determines that wrapped tokens are undercollateralized, Chainlink Automation can be utilized to halt the minting, redeeming, and burning of wrapped tokens.

- Released last week, it stated that on the time of assessment, Binance managed in-scope property in excess of 100% of their complete platform liabilities.

- Furthermore, Chainlink PoR can be more and more being used to assist safe the minting, redeeming, and burning of wrapped belongings.

- Nexo launched in 2018 and presents a platform for users to earn interest on their crypto or draw credit score traces utilizing their crypto as collateral.

- It also solely exhibits the on-chain assets of the custodian; it doesn’t monitor the place these belongings come from (i.e., whether or not the belongings have been borrowed for the needs of the audit).

- Through this data, the economic exercise of stablecoins can speed up inside DeFi not only from retail users but also from conventional institutions that are in search of to securely generate yield within the decentralized finance ecosystem.

If any asset on the record does not meet this requirement, an inventory of belongings is outputted, and emergency actions may be performed. As a extremely flexible and transparent oracle community model, Proof of Reserve helps accelerate the expansion of DeFi by offering collateralization knowledge on a big selection of belongings and unlocking cross-chain liquidity. As Chainlink is blockchain-agnostic, Chainlink PoR feeds may be constructed to provide collateralization knowledge on any cross-chain asset settled on any good contract-enabled blockchain.

Deje su comentario